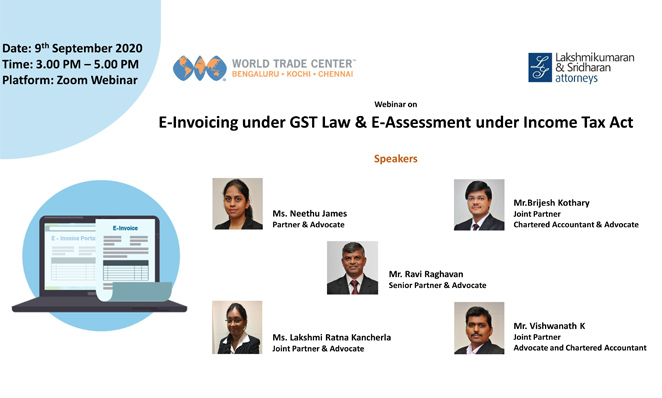

World trade Center in association with Lakshmikumaran and Sridharan Attorneys organized a webinar on “E-Invoicing under GST Law & E-Assessment under Income Tax Act”.

Subject matter Experts from LKS, Bengaluru spoke and interacted with the participants

- Mr. Ravi Raghavan, Senior Partner & Advocate

- Ms. Neethu James, Partner & Advocate

- Mr. Brijesh Kothary, Joint Partner, Chartered Accountant & Advocate

- Ms. Lakshmi Ratna Kancherla, Joint Partner & Advocate

- Mr. Vishwanath K, Joint Partner, Advocate and Chartered Accountant

Mr. Ravi Raghavan provided an overview of the topic. He said that e-invoicing does not mean Government is going to raise invoices. The scheme of e-invoicing is more of a reporting done online. The assessee is required to report his transaction through an invoice registration portal. The information that is fed through this model will help the department to auto-populate recipients GSTR2A and 2B.Going ahead this data will form as a base for monthly returns.

Speakers commented that Faceless Assessment Scheme, 2019 announced by the Government as part of its e-governance initiative for Income-tax assessments has recently been expanded in scope and reach. As part of the “Transparent Taxpayer” initiative launched by the Prime Minister, the IT Department is moving towards total computerisation to improve efficiency in delivery of services and to bring about greater transparency. The e-invoicing has created a new standard to prepopulate returns and thereby provide better taxpayer services. It has also reduced tax evasion and improved the overall efficiency of the department.

Ms. Lakshmi Ratna K, Mr. Vishwanath K. and Mr. Brijesh Kothary together presented their views on e-invoicing while Ms. Neethu James spoke on faceless assessment.

The speakers addressed the myths and unanswered questions on the concept of e-invoice during the session. The e-invoice standards which would enable businesses to communicate their business transactions in a seamless digital mode were also discussed. The nuances of the Faceless Assessment Scheme in order to familiarise businesses with the new normal and also caution about the challenges in implementation of the Scheme. Dr. Bose Nair, Vice President of WTC also spoke.