Remission of Duties and Taxes on Exported Products (RoDTEP) Scheme

28/01/2021 | Completed Event

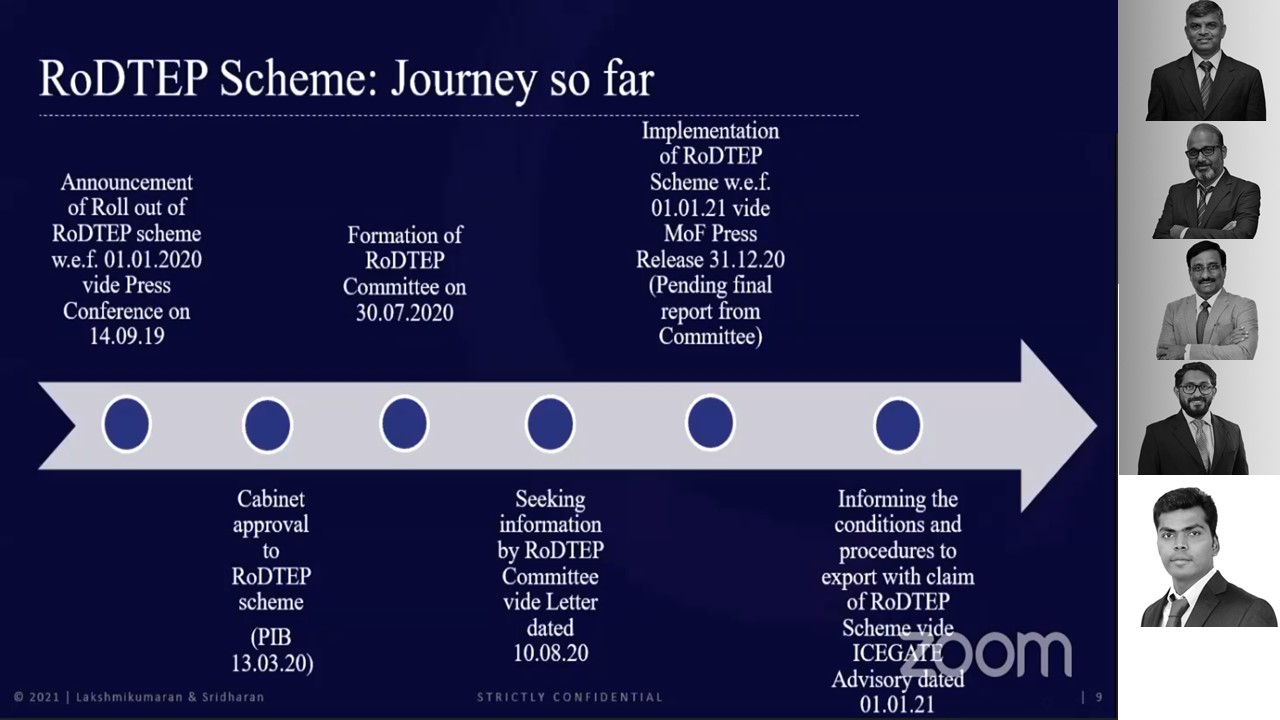

The Finance Ministry in the press conference held on 14th September 2019 announced the rollout of Remission of Duties and Taxes on Exported Products scheme (RoDTEP) replacing the existing Merchandise Exports from India Scheme (MEIS). In this context, World Trade Center organized a Webinar on the RoDTEP Scheme. Experts from Lakshmikumaran & Sridharan Attorneys – Mr. Ravi Raghavan, Senior Partner; Mr. P.M. Prabhakaran, Partner; Mr. Srinivasan, Joint Partner; Mr. Karthik Nair, Joint Partner and Mr. Kalirajan D., Principal Associate were the speakers. Mr. Ravi Raghavan in his introductory address gave an overview of the scheme. The scheme at its early stage still poses various challenges to exporters. Mr. Prabhakaran gave a background of the scheme and how it came to being. The reason for introduction of the RoDTEP scheme was to overcome the legal challenges faced by India at WTO as the MEIS scheme was challenged by USA and other countries for being inconsistent with Article 3.1(a) of the Agreement on Subsidies and Countervailing Measures (SCM). Some of the existing schemes like export oriented units/EHTP/BTP, Export Promotion Capital Goods Scheme were challenged as there were several claims by United States against several subsidies that were provided to the exporters which had put some of the US importers at a disadvantage. The MEIS Scheme has been discontinued with effect from 31st December 2020 and RoDTEP commenced on 1st January 2021. Mr. Karthik Nair explained the salient features of the scheme. RoDTEP would refund the embedded Central, State and local duties/taxes that were not being refunded. It is also WTO compliant. The refund would be credited in an exporter’s ledger account with Customs and would be used to pay Basic Customs duty on imported goods. The credits can also be transferred to other importers. The RoDTEP rates would be notified shortly by the Department of Commerce.Mr. Kalirajan explained the conditions and procedures for availing the benefits of the scheme. RoDTEP requires the filing of a Declaration of intent. Mr. Srinivasan discussed the potential practical issues of the scheme at this stage.